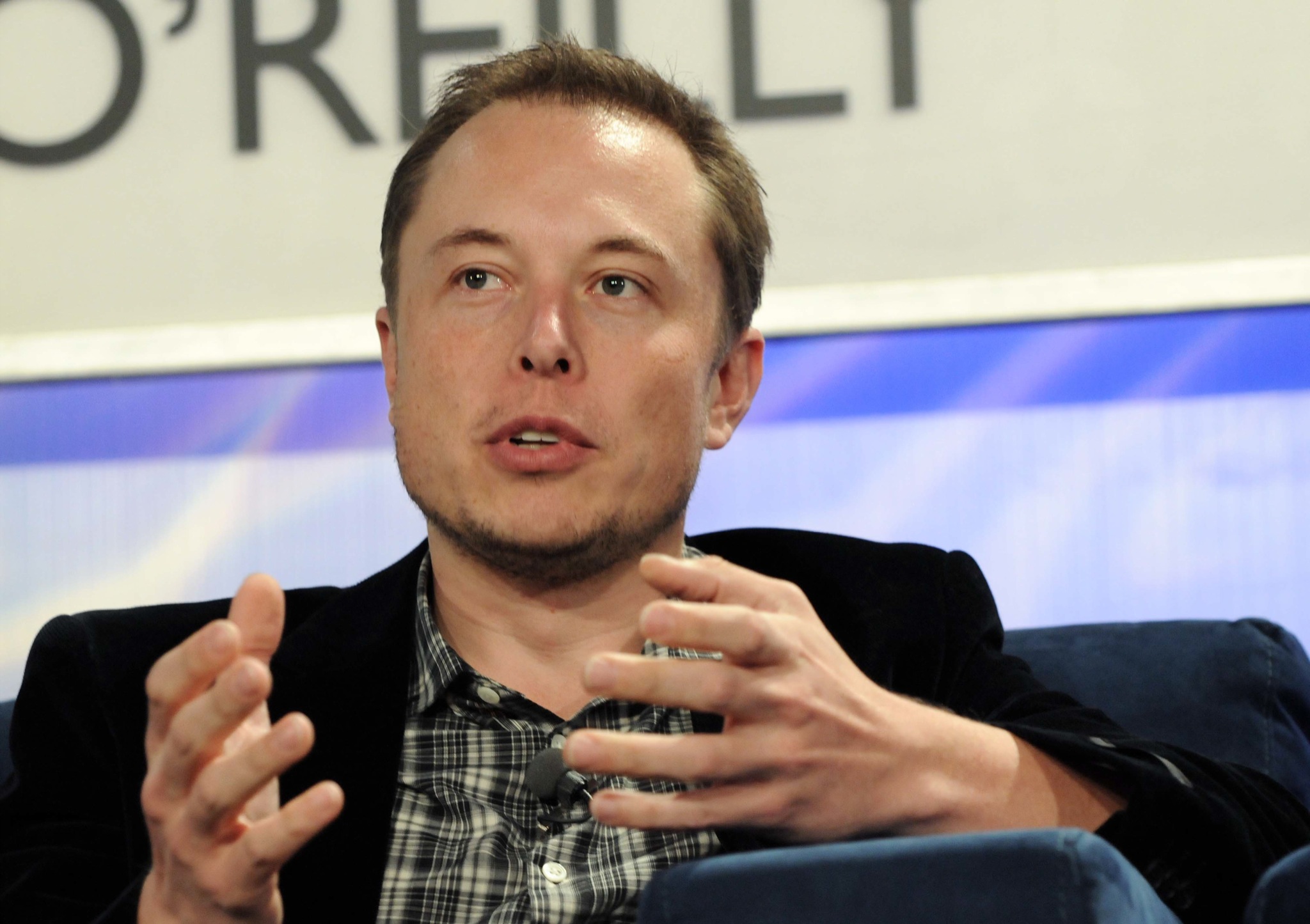

Elon Musk’s companies are approaching a $1 trillion combined valuation. Explore how SpaceX, Starlink, AI, and Tesla are reshaping global power, infrastructure, and the future of technology.

Introduction: Why $1 Trillion Is No Longer Science Fiction

For years, a $1 trillion valuation sounded like an abstract milestone reserved for nation-states and oil empires. Today, that number is increasingly associated with one individual’s technology ecosystem: Elon Musk.

What’s different now is not hype — it’s infrastructure.

Space launch dominance, global satellite internet, artificial intelligence, autonomous systems, and energy platforms are converging into a single, tightly controlled ecosystem. Analysts are no longer asking if Musk’s companies could reach a combined trillion-dollar valuation — but how soon, and what that means for the world.

SpaceX: From Rocket Company to Strategic Infrastructure

At the center of the trillion-dollar discussion is SpaceX.

Once viewed as a risky private space startup, SpaceX has become:

- The world’s leading launch provider

- The backbone of NASA’s human spaceflight

- A critical contractor for defense and intelligence agencies

Why SpaceX Is Different

Unlike traditional aerospace firms, SpaceX:

- Reuses rockets at scale

- Launches faster and cheaper than competitors

- Controls its own satellite network (Starlink)

This vertical integration has turned SpaceX into strategic infrastructure, not just a commercial business. Governments now depend on it — a key factor that dramatically increases long-term valuation confidence.

Many financial models estimate:

- SpaceX without Starlink: $200–300B

- SpaceX with Starlink at scale: $800B–$1.2T

Starlink: The Quiet Global Power Shift

Starlink is arguably the most underestimated part of Elon Musk’s empire.

What Starlink Really Is

Starlink is not just “internet from space.” It is:

- A global communications layer

- Independent of local telecom monopolies

- Functional in war zones, remote regions, oceans, and airspace

It is already used by:

- Rural communities

- Airlines and shipping companies

- Emergency responders

- Military and humanitarian operations

With millions of subscribers projected globally, Starlink represents:

- Recurring subscription revenue

- Near-zero direct competition at global scale

- Massive geopolitical leverage

In simple terms: whoever controls global connectivity controls influence.

AI and xAI: The Intelligence Layer

While SpaceX and Starlink provide physical infrastructure, AI provides intelligence.

Elon Musk’s AI strategy is unique because it is:

- Integrated into real-world systems (cars, robots, satellites)

- Trained on live, physical data — not just text

- Designed to operate autonomously in high-risk environments

Why xAI Matters

xAI is positioned as:

- An alternative to Big Tech AI monopolies

- A system optimized for decision-making, not just conversation

- A bridge between digital intelligence and physical reality

When AI is combined with:

- Satellites (Starlink)

- Autonomous vehicles (Tesla)

- Robotics (Optimus)

- Space systems (SpaceX)

…it becomes infrastructure intelligence, not just software.

Tesla: The Multiplier, Not the Core

Tesla alone may not reach $1 trillion again in the short term — but it plays a critical supporting role.

Tesla contributes:

- Massive real-world data for AI training

- Energy storage systems (Megapack)

- Autonomous technology at scale

More importantly, Tesla acts as a deployment platform for Musk’s AI ambitions — from vehicles to robots to energy grids.

Why This Is About Power, Not Just Money

A $1 trillion valuation is symbolic. The real shift is structural.

What Changes When Private Companies Reach This Scale?

- Private infrastructure rivals nation-states

- Governments become customers, not controllers

- Technology defines geopolitical influence

- Innovation speed outpaces regulation

This represents a new model of global power, where:

- Capital

- Data

- Infrastructure

- Intelligence

…are unified under a single ecosystem.

Risks That Could Slow or Stop the $1 Trillion Path

This future is not guaranteed.

Key risks include:

- Regulatory backlash

- Antitrust actions

- Geopolitical resistance

- Overdependence on government contracts

- Public trust and governance concerns

However, Musk’s strategy of operating across multiple sectors and jurisdictions reduces single-point failure — another reason investors take the trillion-dollar scenario seriously.

Why This Matters for Africa and Emerging Markets

For regions like Africa, this shift is especially important.

Starlink already:

- Bypasses weak terrestrial infrastructure

- Connects rural and underserved areas

- Enables AI, fintech, education, and agritech platforms

The same technologies driving Musk’s valuation could also:

- Accelerate digital inclusion

- Reduce infrastructure inequality

- Enable leapfrogging in innovation

For hubs like ICTHubs, understanding these dynamics is not optional — it’s strategic.

Conclusion: The Empire Is Infrastructure

Elon Musk’s path to a $1 trillion empire is not built on apps or social media trends. It is built on:

- Rockets

- Satellites

- Energy

- Intelligence

- Autonomy

Whether or not the trillion-dollar milestone is reached this year or next, one thing is clear:

Global power is no longer defined only by governments — it is increasingly shaped by technology ecosystems.

And Elon Musk is building one of the most consequential ecosystems the world has ever seen.